Invest in Indian Stock Market

The simplest way to invest in stocks, options, and ETFs.

Indian share market indices

Indian share market today

ZOMATO

₹208.07

-1.52%▼

IDEA

₹7.34

1.10%▲

RELIANCE

₹1,247.30

0.72%▲

HDFCBANK

₹1,685.50

0.12%▼

ICICIBANK

₹1,245.40

2.51%▲

INFY

₹1,661.60

-2.34%▼

INDUSINDBK

₹655.95

-27.16%▼

TATASTEEL

₹150.75

0.20%▼

BHARTIARTL

₹1,662.95

1.96%▲

ITC

₹406.20

0.30%▲

YESBANK

₹16.37

0.91%▼

SUZLON

₹53.76

0.98%▲

BEL

₹277.18

1.78%▲

SBIN

₹729.85

0.13%▲

NTPC

₹330.30

0.27%▲

IOC

₹124.82

2.66%▲

ONGC

₹226.72

1.58%▲

JIOFIN

₹217.56

0.49%▲

IRFC

₹119.30

0.38%▼

TCS

₹3,575.30

0.40%▼

At 52 Week High

Stocks to Buy Today

This page highlights top stocks with strong growth potential, featuring companies favored by analysts. It offers insights into market trends, both bullish and bearish, along with real-time updates on market movers.

Invest in Current IPOs

Be one of the first to buy shares of new companies before they're available to everyone else. Get the latest updates on Live IPOs and Upcoming IPOs. This way, you won't miss any chance to invest.

Current IPO

A Live IPO, also referred to as a Current IPO, is an IPO that is currently open for subscription. During this period, investors can apply for shares at the offered price. A Live IPO typically lasts for a few days, during which potential investors can place their bids to purchase shares.

How to Invest in Indian Stocks?

Start investing in the Indian stock market with INDstocks by INDmoney using these easy steps:

Create a Demat Account

Sign up with your phone number and enter the OTP to open a Demat account with INDstocks by INDmoney.

Complete KYC

Discover Stocks & ETFs

Browse from a selection of stocks and ETFs and pick your preferred choice.

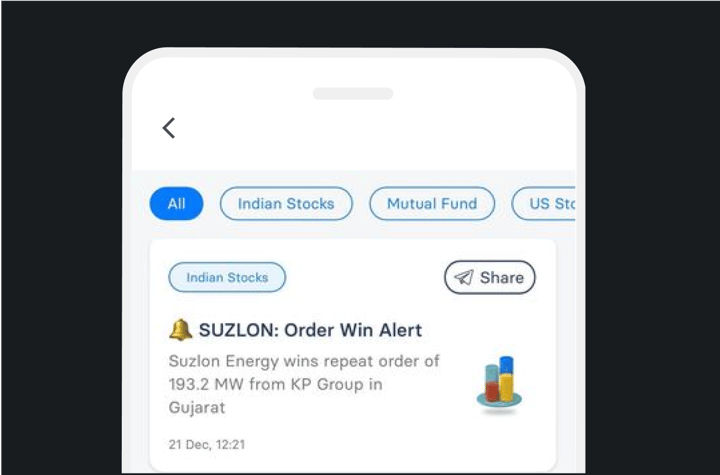

Access Real-Time Updates

Receive free insights on your portfolio and the latest updates on markets from INDstories.

Add Funds & Invest

Put money into your INDstocks Wallet and use those funds to purchase your chosen stock.

Monitor & Track Investments

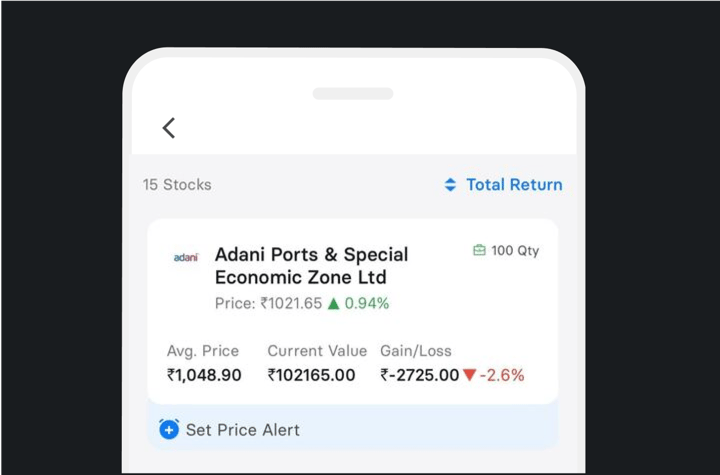

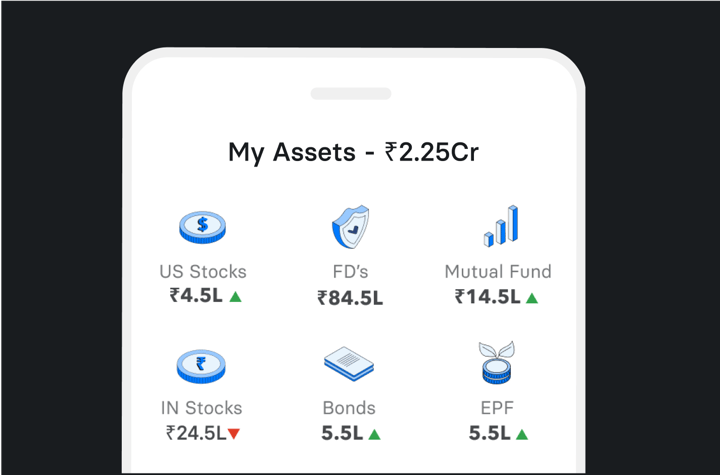

View your daily gains and losses and manage all your investments conveniently from a single dashboard.

Powerful features on INDstocks

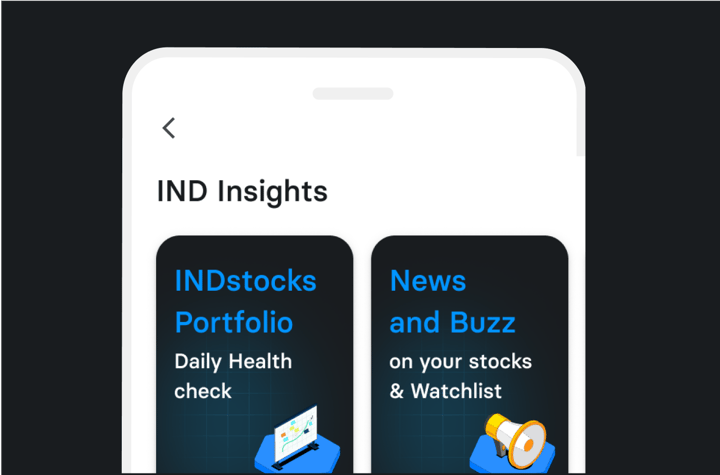

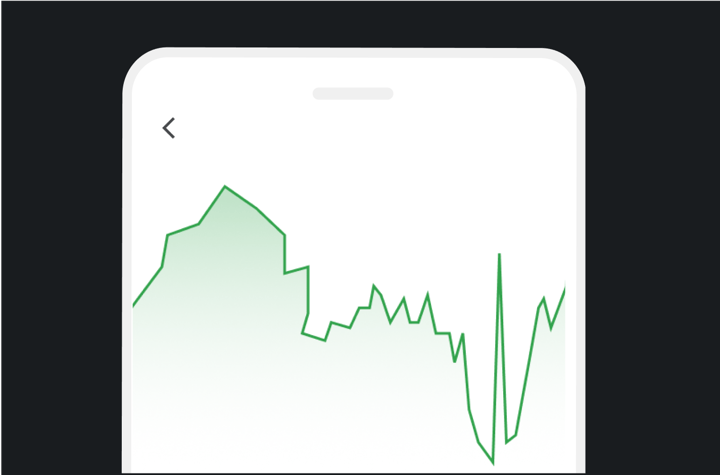

Stock market daily Insights & watchlist

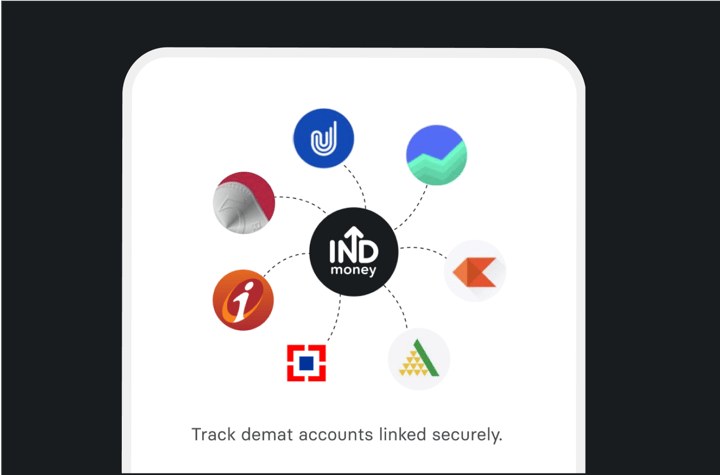

Auto-Sync your portfolio from all brokers

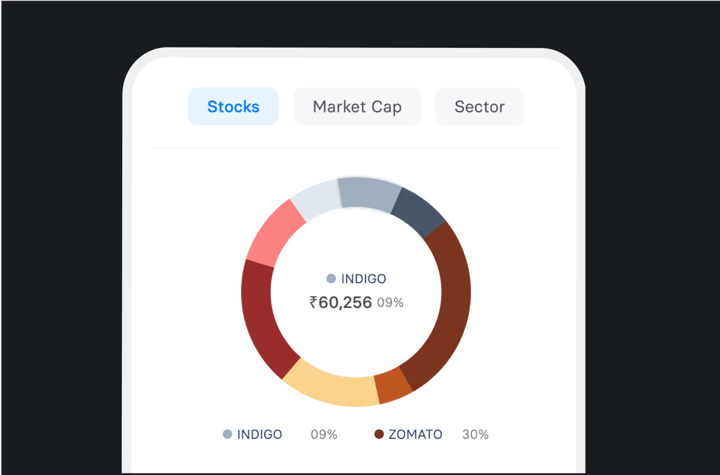

Get free performance analytics of your Shares

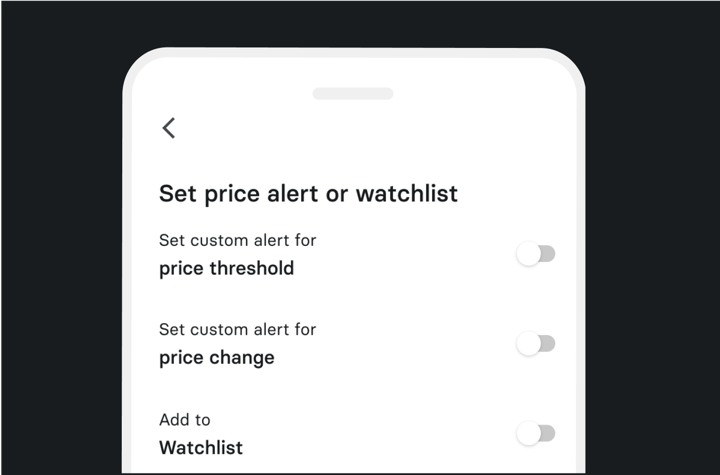

Set custom price alerts to track specific stocks

Smart Alerts & WhatsApp Notifications

Trade better with our advanced charts

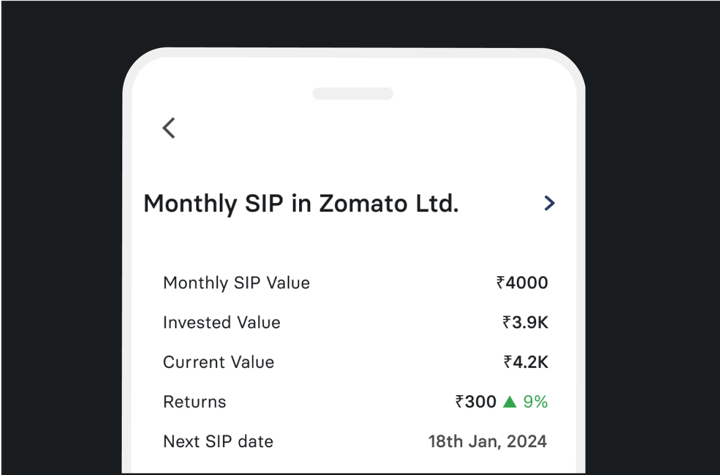

Control all your SIPs in Shares from one place

See live price with auto refreshing every sec

Track all your investments in one app

Frequently Asked Questions

What exactly is stock investment?

Stock investment means buying shares in a company to gain a portion of ownership. It gives you a chance to earn profits through growth or dividends.

Is it possible to invest as little as 10 Rs in the share market?

Yes. The Indian share market has no minimum investment barrier. You can start trading with even as little as Rs 10. You can begin with small amounts, adjusting your investment based on personal financial goals and risk appetite.

How can beginners buy stocks?

For beginners, the simplest way to get into stock investments is by opening an online brokerage account. It will let you buy or sell stocks. Consulting with a professional to manage your portfolio should also be done.

Are stocks a good investment?

Stocks offer high potential returns but come with significant risk, making them a good but volatile investment.

What are the types of stocks?

Stocks come in two main types: common shares, offering ownership and voting rights, and preferred shares, providing fixed dividends.

How do stocks make money?

You can make money from stocks through price appreciation or dividends, selling for a profit or receiving periodic income.

Trusted by 10 million+ happy investors

Open your account in a minute. Invest in Indian Stocks, US Stocks, Mutual Funds, ETFs, Fixed Deposit and NPS.

INDmoney is 100% Safe and Secure!

Your security and privacy are our top priority!

27001:2022

ISO Certified

Audited by

cert-in empanelled auditors

AES 256-BIT

SSL Secured

Your personal information is protected.

With AES 256-bit encryption and TLS 1.3 secure data in transit.