Invest in Mutual Funds

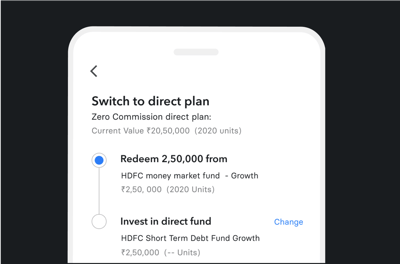

Invest in 1600+ Direct Plan Mutual Funds. Set up SIPs with UPI Autopay and manage them with full control—edit, pause, or cancel anytime. Invest in lumpsum (one-time). Easily switch from Regular to Direct Plans.

Explore 1600+ Mutual Funds

Zero Commission Direct Plans

₹0 Maintenance Cost

No Hidden Charges

What is a Mutual Fund?

A Mutual Fund is a pooled investment scheme. It collects funds from various investors who share a common investment objective. The pooled money is managed by a professional fund manager who invests the funds in a diversified portfolio of stocks, bonds, and other securities. Investors who contribute to a mutual fund receive “units” based on their investment amount. The number of units is based on the prevailing Net Asset Value (NAV) which represents the total value of the fund's assets minus the liabilities, divided by the number of units outstanding. Mutual Funds are established as Trusts and are regulated by the Securities and Exchange Board of India (SEBI).

How to invest in Mutual Funds?

3 steps to start your Mutual fund investment journey

Step 1

Open a Free Mutual Fund account by Completing Digital KYC

View Details

Step 2

Select a Mutual Fund

View Details

Step 3

Invest One Time or SIP with as low as ₹100

View Details

Benefits of Investing in Mutual Funds

Professionally Managed

Mutual funds enable access to experienced fund managers who are experienced in monitoring the market and economic trends and making informed investment decisions.

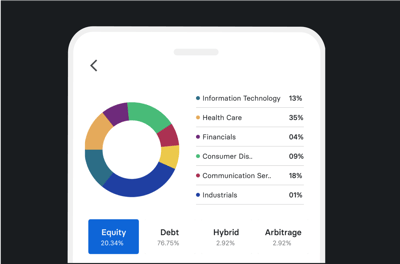

Diversification of Investments

Mutual funds invest in a variety of securities across different asset classes. This helps reduce risk by reducing the losses that may happen in a single investment.

Affordable

Mutual funds allow investments with very low amounts, as little as ₹100 for some open-ended schemes. This makes it very easy to get started and get access to diversified portfolios.

Cost Efficiency

Since Mutual funds are pooled investments, they benefit from economies of scale resulting in lower expense ratios. Typically cost ranges from 1% to 2.5% which is competitive for the fund manager's services.

Tax Benefits

Mutual funds under the ELSS schemes offer tax benefits under section 80C of the Income Tax Act for up to ₹1.5 lakhs per annum. Further, the long-term gains on Equity mutual funds are taxed lower.

Regulated

Mutual funds are regulated by the Securities and Exchange Board of India (SEBI) which enforces high standards of transparency and investor protection.

Mutual Funds by Category

Mutual funds can be classified into three main categories: Equity, Debt, and Hybrid Mutual Funds.

1. Equity Mutual Funds

Large Cap Mutual Funds

Mid Cap Mutual Funds

Small Cap Mutual Funds

Flexi Cap Mutual Funds

2. Debt Mutual Funds

Money Market Funds

Corporate Bond Funds

Overnight Funds

Liquid Funds

3. Hybrid Mutual Funds

Aggressive Funds

Arbitrage Funds

Multi Asset Funds

Equity Savings Funds

Ways to Invest in Mutual Funds: SIP vs Lumpsum(One Time)

Place a SIP order of Mutual Fund

Start an SIP in Mutual Funds with just ₹50

Start SIP in a mutual fund

SIPs enable you to invest fixed amounts at regular intervals, fostering a habit of disciplined investing. Here’s a comprehensive guide to starting your SIP and maximizing its benefits

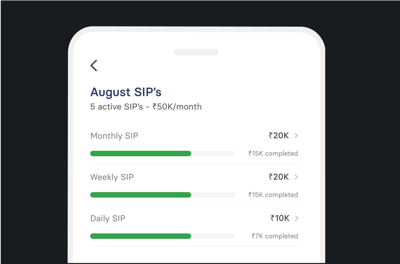

Select SIP Frequency & SIP Amount

You can choose to invest weekly, monthly, or quarterly. Monthly investments are popular as they coincide with salary payments, making it easier to allocate funds consistently.

Advance SIP options

On INDmoney, you have an advanced SIP option “Step Up” that allows you to automatically increase your investment amount at specified intervals. For example, if you set up a monthly SIP of ₹5,000 and choose to Step Up by ₹500 every quarter, your contributions will increase by ₹5,500 after 3 months, ₹6,000 after 6 months, and so on.

Setup Autopay for Automatic Deduction

With Autopay, the SIP amount will be automatically deducted from your bank account on the selected SIP date. It helps eliminate the need for manual approval of transactions for each installment.

Enjoy Compounding Benefits

The most significant advantage of investing through SIPs is the power of compounding. Even small investments on regular intervals can grow significantly over long periods due to compounding returns.

Place a Lumpsum(one-time) order of Mutual Fund

Invest Lumpsum(one time) on INDmoney

A lump sum investment involves investing a large amount of money in one go instead of period smaller installments. This method can lead to higher returns if timed correctly but carries greater risk due to market exposure.

Enter Investment Amount

Enter the lumpsum amount for a one-time investment. This method is straightforward and requires less ongoing management compared to SIPs.

Instantly Buy

Authorize your investment by entering OTP and completing the payment to place your order.

How do I redeem/sell my Mutual Fund?

Process of selling/redeeming Mutual Funds on INDmoney

Go to the Mutual Funds Dashboard

My Funds will display the listing of all invested and tracked Mutual Funds on INDmoney.

Select the fund you want to redeem

Click on the fund you want to sell/redeem

Click on the Redeem/Sell option

Choose the sell/redeem option from the bottom sheet. You will be taken to the redemption page.

Enter the amount or units you want to redeem

You can verify your primary bank linked to your folio and enter the amount you want to redeem/sell.

Instant Redeem/Sell

Authorise the transaction by entering OTP and instantly place a redeem order in just a few clicks. The amount will be credited to your bank in 2 business days.

Key Features of Investing in Mutual Funds via INDmoney

SIP Center to Control all your SIPs

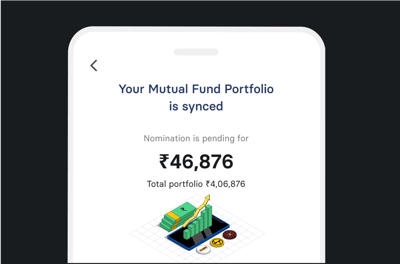

Import and Track your external mutual funds

Switch from Regular to Direct plans

Get Free Mutual Funds Portfolio Scan

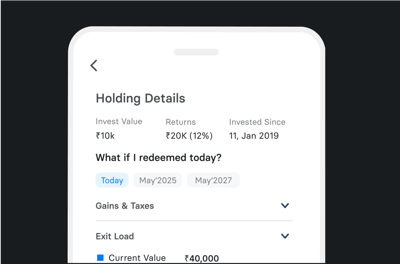

Find hidden charges, exit loads & tax liability

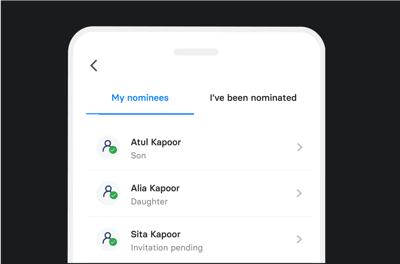

Set nominees for all your mutual funds

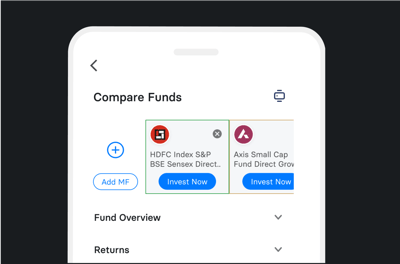

Compare mutual funds across returns, cost, AUM, etc

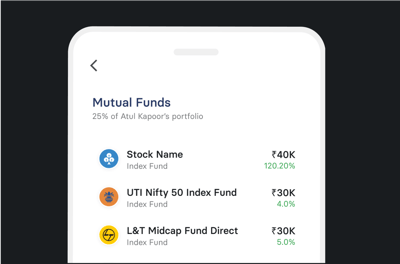

Manage your family mutual funds portfolio

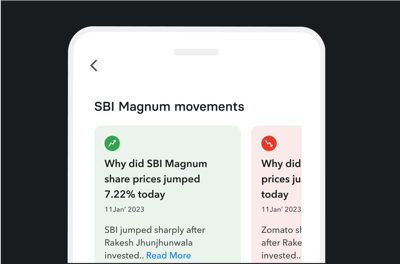

Get news and insights on your mutual funds portfolio

Mutual Funds Collections

A curated selection of the best mutual funds for different investment goals

Trending Funds

Invest in funds that have been popular with the INDmoney investors in the past 6 months.

Build Wealth

Top Performing Mutual Funds are investment vehicles known for consistently outperforming their peers by delivering superior returns.

Tax Savers / ELSS

Equity-Linked Savings Schemes (ELSS) are tax-saving mutual funds that invest primarily in equities and equity-related instruments. These funds offer the dual benefits of potential capital appreciation and tax deductions under Section 80C of the Income Tax Act in India.

Gold Mutual Funds

Gold mutual funds offer investors a convenient and cost-effective way to potentially benefit from the price movements of gold without physically owning the precious metal, providing a hedge against inflation and market volatility for potential long-term growth.

High Return Funds

High Return Funds are investment vehicles strategically designed to achieve superior returns by focusing on high-growth assets like equities and high-yield securities.

Best SIP Funds

Best SIP Funds is a list of hand-picked mutual fund schemes that have given better SIP returns compared to other Funds in the same category.

Low Risk Funds

Provides stability and preserve capital while offering modest returns. These funds typically invest in securities that have lower volatility and are less sensitive to market fluctuations.

Moderate Risk Funds

These mutual funds are investment vehicles designed to offer a balance between risk and return, catering to investors who seek a middle ground between aggressive growth and capital preservation.

High Risk Funds

These funds are investment vehicles designed for investors who are willing to accept a higher level of risk in exchange for the potential for substantial returns.

₹1,00,000 Crore worth of Mutual Funds managed on INDmoney

My favourite app

Ind Money is my favourite app to Invest in Stocks & Mutual funds I love this app because it shows all my investments including pf in one place

Ajay Singh

Aug 24, 2024, 20:01

Superb app to keep track of all of your money

Just the app I was looking for! It helps to track money in all my bank accounts (HDFC, ICICI, IndusInd, Kotak), Credit Card bills, money deposited in my NPS, PPF, Stocks/Shares, Mutual Funds and more all in one place and keeping everything updated automatically! Works like a magic. Highly recommend to use for managing financials.

Srijan Saxena

Aug 25, 2024, 11:00

Ease of Use

So easy to use. Proper information updated on this app. Anyone who haven't any knowledge about to select mutual funds this app provides proper information. so excellent app.

Yeegaram Karale

Sep 14, 2024, 18:15

Best for Mutual Funds

I loved using INDmoney to invest in mutual fund. I have even referred this to my friends and family. The interface is so informative and easy understanding. Recommendation of mutual fund are as per research and past investments.

Akash Pattjoshi

Sep 25, 2024, 17:33

Awesome app to track all your investments

It's very useful application where you can track stocks mutual funds nps ppf etc. You also invest in stocks and mutual funds. You can track your credit card and pay bills as well.

wsaq0909

Sep 29, 2024, 16:22

Good for new investors

I suggest new investor to invest in this app with no AMC and it has lots of investment options such as Mutual funds,fixed deposit and u can track bank balance any time and expenses.They have best customer support and your query will be solved in 24 hours

Adithya Prabhu

Oct 1, 2024, 20:43

Important Questions About Investing in Mutual Funds

When were Mutual Funds introduced in India?

The mutual fund industry in India began in 1963 with the establishment of the Unit Trust of India (UTI), which was initiated by the Government of India and the Reserve Bank of India (RBI). The first fund launched by UTI was the Unit Scheme 1964 (US-64), which became immensely popular and attracted millions of investors over the years.

In 1987, the mutual fund industry opened up to public sector banks and institutions. The State Bank of India (SBI) launched its mutual fund, becoming the first non-UTI mutual fund, which expanded access to retail investors.

1991 saw the economic liberalization schemes and led to the introduction of private sector mutual funds. This period saw increased competition and innovation within the industry, allowing for a broader range of investment options. SEBI was established in 1992 as a regulatory authority for the securities market, including mutual funds, enhancing investor protection and market integrity.

By early 2003, the mutual fund industry had grown to include 33 schemes with a total Assets Under Management (AUM) of approximately ₹1.22 lakh crore, reflecting significant growth since its inception. By 2014, the AUM crossed ₹10 lakh crore signaling a resurgence in investor interest and participation in mutual funds, particularly through Systematic Investment Plans (SIPs).

2020 saw another AUM milestone surpassing ₹30 lakh crore. As of September 2023, the mutual fund industry’s AUM reached approximately ₹46.58 trillion, reflecting over sixfold growth from ₹7.46 trillion in September 2013 and highlighting the industry's robust development over recent years.

Today the industry is a thriving ecosystem with around 44 asset management companies.

What is NAV(Net Asset Value) in a Mutual Fund and how is this calculated?

Net Asset Value(NAV) represents the market price of one unit of a mutual fund. For example, if the mutual fund has total assets worth ₹10,00,000 and liabilities worth ₹50,000, with 1,00,000 units, the NAV would be (₹10,00,000 - ₹50,000)/1,00,000 = 9.5. This means that each unit of the fund is worth ₹9.5.

The NAV of a mutual fund is a key indicator of the performance of underlying assets in the fund’s portfolio. It can be used to track a fund's growth over time.

The NAV of all mutual funds changes on a daily basis. It is calculated at the end of each trading day, using the closing market prices of the underlying securities in the fund’s portfolio.

What is an Asset Management Company(AMC)?

An AMC is a financial institution that launches and operates different mutual fund schemes. It manages money invested by individuals, institutions, and businesses through various mutual funds. AMCs pool money from multiple investors to create a common fund, which is then used to purchase securities such as stocks, bonds, money market investments, etc.

AMCs employ fund managers who make investment decisions on behalf of investors. AMCs also manage all administrative aspects, like regulatory compliance and fund performance analysis. All AMCs in India are regulated by SEBI to ensure they operate within the legal framework and adhere to high standards of transparency and accountability.

AMCs earn revenue by charging an expense ratio for each mutual fund scheme. This includes management fees as compensation for managing the fund and covering other costs for operational expenses.

A few prominent AMCs in order of fund size are SBI Mutual Fund, ICICI Mutual Fund, HDFC Mutual Fund, Axis Mutual Fund, etc. Click here to explore all AMCs in India

What is the Expense ratio in a Mutual Fund?

The Expense Ratio is the annual fee a mutual fund charges its investors to cover its expenses. It compensates for costs such as management fees, administrative fees, and any other operational expenses the AMC incurs to run the fund.

Expense Ratio is calculated as a percentage of total annual expenses divided by the average AUM (Assets under Management) of the mutual fund. For example, an expense ratio of 1.5% represents that ₹1.5 will be charged for every ₹100 invested in the fund annually.

A higher expense ratio indicates that more investors' money is being used to cover operational expenses rather than directed toward the fund's investment pool, which can lead to lower returns over time. It is also used by investors as a comparison tool when choosing between similar funds within a category.

SEBI has set limits on the maximum and minimum expense ratio that an AMC can charge for a specific mutual fund. The limits are set based on the funds' AUMs and have a tiered structure. For Equity funds, the maximum expense ratio that can be charged is 2.25% vs. 2.0% for Debt funds.

How do I calculate returns in a mutual fund?

There are different methods of calculating the returns of a mutual fund, each suited to different types of investments and time frames. Let's understand these methods:

Absolute Return: This is the simplest method. It is the percentage change in the value of your investment over a specific period. It does not consider the time over which this change occurred. Example: If you invested when the NAV was ₹10 and sold when it was ₹12, your absolute return would be 20%

Compound Annual Growth Rate (CAGR): This is the annualized rate of growth of an investment over a specified period, also considering the time taken. For example, if you invested when the NAV was ₹10 and sold when the NAV was ₹20 after 1.5 years, your CAGR would be 15.43% = (12/10)1/1.5

Besides Absolute Return and CAGR, in reality, investments in mutual funds happen in multiple installments over some time. The above two methods do not account for such a scenario. To solve this, we have two more methods:

Time Weighted Rate of Return (TWRR): This method breaks down the investment period into multiple sub-periods based on when cash inflows and outflows happened. Then calculates the absolute return for each sub-period and aggregates them together for the total investment period return. Note that the size of the cash flow is ignored in this method.

Extended Internal Rate of Return (XIRR): This method accounts for both the timing and size of each cash flow in your investment over time. It is the most comprehensive measure of the annual rate of return on an investment. It can also easily support other cash flows like dividends, interest payments, etc in the calculation to give a complete picture of the total return.

What is the exit load in a mutual fund?

Exit Load is a small fee that some AMCs (Asset Management Companies) charge the investor if they choose to withdraw (or redeem) the investment before a specific time period.

The purpose of exit load is to discourage investors from withdrawing investments before a certain time frame. Exit load structure varies from fund to fund. It is usually a percentage of the amount being redeemed/sold. For example, if the exit load is 1% and an investor redeems ₹10,000 worth of units, the fund will deduct ₹100 as the exit load.

How to evaluate and decide which Mutual Fund to buy?

Selection of a mutual fund should be based on your investment goals and risk profile. The key aspect is your goal's time horizon. If your goal is more than 5 years away you can consider equity mutual funds. If not, you should consider a mix of hybrid or debt mutual funds to lower risk for shorter time periods.

Within the broad categories of equity, debt and hybrid there are sub categories to choose from based on different risk levels.

Equity Funds are evaluated based on their ability to beat the benchmark (active funds) or on their tracking error (passive funds). For active mutual funds, the ability to consistently beat the benchmark is a very strong indicator of a well managed fund. If this outperformance comes at a reasonable cost (expense ratio), that is even better. Expense ratios should be compared with funds within the same category, for example, a small cap funds expense ratio should NOT be compared with a large cap active mutual fund.

Passive funds are evaluated on how closely they can mimic the returns of their benchmark. This is measured in terms of their tracking error. Another great way is to plot the rolling returns of the passive fund alongside the benchmark index rolling returns and see their deviation. The lower the better.

Hybrid funds are suitable for medium term goals. They have a mix of equity and debt securities and should be judged on their performance vs. the benchmark. The debt portfolio composition between government (low risk) vs. corporate debt (higher risk) and its credit rating may be considered when choosing a fund.

This evaluation is a continuous exercise and investors should periodically monitoring if their funds are still aligned towards their goals and with change market conditions.

Who is a fund manager in a mutual fund?

The mutual fund manager is the person in charge of executing the fund's investment strategy. The fund manager's role is to make strategic investment decisions to achieve the mutual fund's objectives, balancing risk and potential returns. He is tasked with selecting appropriate securities (stocks, bonds, etc.) based on deep market analysis and research. To oversee the daily trading activities of the mutual fund, ensuring that the portfolio aligns with the fund's goals and adheres to regulations set by the Securities and Exchange Board of India (SEBI).

They are also responsible for monitoring the fund performance and responding to market changes or shifts in economic conditions. They often serve as the face of the mutual fund house, communicating with investors about the funds performance and strategy going forward.

Active Fund Managers: These managers actively make decisions about buying and selling securities with the goal of outperforming a benchmark index. These are active mutual funds where expense ratios are typically higher than passive mutual funds.

Passive Fund Managers: They typically manage funds that track specific indices and do not frequently change the portfolio composition. Their mandate is NOT to outperform the benchmark but to minimize the tracking error.

Do investors lose money by investing in Mutual Funds?

Mutual funds are subject to a variety of risks. Market fluctuations and performance of the underlying holdings can lead to losses. For example, during market downturns like the 2008 financial crisis or the COVID-19 pandemic in 2020, many equity mutual funds experienced significant declines in NAV (Net Asset Value).

Mismatch in investor goals and fund objectives can be another reason for losses. For example, investors who pulled out their investments during the initial market crash in March 2020 may have realized losses that could have been avoided had they stayed invested. Aligning your mutual fund investments with your financial goals and time horizons can help avoid such losses.

If a fund manager makes poor investment decisions or fails to adapt to changing market conditions, it can lead to underperformance and losses for investors. For example, on April 23, 2020, Franklin Templeton announced the closure of six debt funds due to severe liquidity issues exacerbated by the onset of the COVID-19 pandemic.

Funds that focus on specific sectors (e.g., technology, defense, healthcare) can be particularly vulnerable to downturns in those sectors. For example, if a sector experiences regulatory challenges or economic downturns, sector-focused funds may suffer greater losses compared to more diversified funds.

What are all the charges to invest in Mutual Funds via INDmoney?

When you invest in Mutual Funds via INDmoney, you are not charged any fee for account opening, tracking or to switch from regular to direct commission funds which can help you save up to 1.5% on commissions charged by regular mutual funds.

Considering the charges that you may have to pay on your Mutual fund investment outside of INDmoney, then the same include:

- Expense Ratio or the fund management fee/commission charged by the AMC to manage the fund on your behalf.

- Stamp Duty(STT) levied by the government as 0.005% for purchase of the mutual fund and on equity-oriented mutual funds (sale) STT is applicable as 0.001% for redemption.

- Taxation charges include Short Term Capital Gains Tax taxed at 20% for funds held for less than a year and Long Term Capital Gains Tax charged as 12.5% on gains greater than ₹1.25 lakh annually for funds held for more than 1 year.

- Exit loads or the fee charged by the mutual fund houses if units are sold within a certain period from the date of investment.

- Dividends are taxable as per your income tax slab.

You can refer to the complete pricing details for Mutual Funds here to make a confident investment decision.

Can I invest in Mutual Funds under my child’s(minor) name?

Yes, you can invest in mutual funds under your minor child’s name in India. Investing in your child’s name gives them a head start on wealth accumulation and the benefit of compounding and the investment starts much sooner.

To get started, you will be required to set up a Mutual Fund account in your child’s name. This account must be operated by the parent/guardian.

You will need your PAN card, Aadhaar, and KYC verified. For your child - you will be required to show the birth certificate/passport or verify age and relationship with the guardian. The investments can be made as lump sums or through a Systematic Investment Plan (SIP).

Additional guidelines:

- Only the guardian can operate the minor’s account until the child turns 18.

- Upon turning 18, the minor must complete KYC requirements, and the account will be transferred to their name.

- Earnings are clubbed with the guardian’s income unless the minor earns separately through other investments.

- Certain investment options like SIP pause and overdraft against investments may not be available in minor accounts.

Can you invest in a Mutual Fund via a Joint account?

Yes, you can. Joint accounts for mutual fund investments are commonly used by couples, parents, and business partners for shared financial goals, as they offer flexibility and convenience. Joint accounts allow investments in various types of mutual funds - including equity, debt, hybrid, and ELSS funds.

In a joint mutual fund account - all account holders must sign off on any transactions, including investments, redemptions, or modifications. All joint holders must submit their PAN cards, and Aadhaar cards, and complete their Know Your Customer (KYC) formalities. While any one holder can operate the account independently, upon the death of one holder - the account automatically transfers to the surviving holder(s).

Do note that joint holding does not provide additional tax benefits and one must remember to appoint a nominee for the account to ensure seamless transfer of assets. Additionally, if a joint holder wishes to exit, a fresh account may need to be created, or joint consent is required for modifications.

What is a New Fund offering (NFO)?

A New Fund Offering (NFO) is like the grand opening of a mutual fund. When an asset management company (AMC) launches a new mutual fund, it offers it to the public at a fixed price, typically ₹10 per unit. This process allows the AMC to raise money to start investing according to the fund's strategy. Think of it as similar to a company’s IPO (Initial Public Offering), where shares are introduced to the stock market for the first time. Investors often consider NFOs if the fund's theme or strategy aligns with their goals. For example, a new fund might focus on environmental sustainability, global markets, or a niche sector. However, it’s essential to research the fund’s objectives and potential before investing.

What is the difference between ETFs and Mutual funds?

ETFs (Exchange-Traded Funds) and mutual funds might seem similar because both pool money from investors to create a diversified portfolio. However, they have some key differences. ETFs are traded on stock exchanges, just like individual stocks. You can buy or sell them at any time during market hours at a price that fluctuates throughout the day. On the other hand, mutual funds are bought or sold directly through the fund company, and the price is based on the Net Asset Value (NAV), which is calculated at the end of the day.

Another difference lies in management and cost. ETFs are usually passively managed, meaning they aim to match the performance of an index like the Nifty 50 or S&P 500. Mutual funds can be actively managed, where fund managers decide which stocks to buy or sell to outperform the market, but this often makes mutual funds more expensive. Finally, ETFs are more tax-efficient because of how they are structured, while mutual funds may trigger more taxes due to frequent buying and selling of securities within the fund.

Is it better to invest via SIP or one time payment?

Deciding between a Systematic Investment Plan (SIP) and a one-time payment depends on your financial situation and market conditions. SIP is a method where you invest a fixed amount at regular intervals, like every month. This approach helps you spread out your investments over time, reducing the risk of market fluctuations. For example, if the market goes down, your SIP automatically buys more units at lower prices, averaging out the cost in the long run. SIPs are ideal for people with a steady income or those who want to stay disciplined with their investments.

A one-time payment, or lump-sum investment, involves putting in a large amount all at once. This can be beneficial when markets are on the rise because your entire investment benefits from the upward trend. However, it carries more risk since poor timing could mean losses if the market declines right after your investment. SIPs are generally safer for beginners, while lump-sum investments may suit experienced investors who are confident about market trends.

If I sell my mutual funds, when do I get my money?

When you redeem your mutual fund investments, the money isn’t transferred to your bank account instantly. The time it takes depends on the type of fund. For equity mutual funds, you usually receive the proceeds within three business days (known as T+3), where “T” stands for the transaction day. Debt mutual funds, on the other hand, are processed faster, typically within two business days (T+2). These timelines can be slightly delayed if your transaction coincides with weekends or holidays. Once processed, the money is directly credited to the bank account linked to your mutual fund investment.

Can I invest in MF’s under HUF?

Yes, HUFs can invest in Mutual Funds. HUF or Hindu Undivided Family is a legal entity, including lineal descendants of a common ancestor who can have their own PAN Card and Bank Account to make investments.

The head male member of a HUF is called a Karta. A Karta can make and manage these investments under his name. The Karta of a HUF is supposed to fill out the non-individual KYC form and submit the following documents:

- PAN Card

- Bank Account Statement

- Deed of Declaration of HUF

Once KYC is complete, the Karta can apply for Mutual Funds provided he explicitly states that he is making that investment on behalf of the Hindu Undivided Family.

How are my Mutual Fund earnings taxed?

Taxation on your mutual fund earnings depend on a multitude of factors. From the category of fund you’ve invested in to the tenure that you’ve held that fund for, there are more than one factor that comes into play when determining your taxes. Let’s understand them in detail:

- Capital Gain: Capital Gain is the profit you make by selling your mutual funds more than at what you bought it for.

- Equity or Debt: Equity mutual funds (65% investments are in Stocks), Debt holdings (65% investments are in Debt instruments) and Hybrid Mutual Funds have different tax liabilities.

- Holding Period: India’s Income Tax Regulations impose a lower tax liability if you hold your investments for a longer period and more tax if you sell your holdings within a short duration from your purchase

Let’s discuss the tax implications when you hold equity and debt mutual funds:

Tax implication for equity mutual funds: Any gain from an equity mutual fund is considered a Short Term Capital Gain (STCG) if sold within 12 months and Long Term Capital Gain (LTCG) if sold after 12 months.

Taxation on your equity mutual funds vary in 2 different situations:

1. If you sold before July 23, 2024: For STCG your tax liability is 15% and for LTCG your tax liability is 10%.

2. If you sold after July 23, 2024: If you realize a Short-term Capital Gain you are liable to pay a 20% tax on your gains. If you hold your equity funds for a year and realize a Long-term Capital Gain you are liable to pay a 12.5% tax on your gains.

Tax implication for debt mutual funds: Two factors come into play, when you calculate taxation for debt mutual funds.

1. If you invested before April 1, 2023

2. If you invested after April 1, 2023

Scenario 1: If you invested before April 1, 2023 - In this case also your tax liability can be divided into two categories:

(i) If you sell before 23rd July, 2024 your long-term capital gain (more than 36 months) is taxed at 20% with indexation benefit. Short-term capital gains in this case are taxed at your slab rate.

(i) If you sell after 23rd July, 2024, your long-term capital (more than 24 months) is taxed at 12.50% with indexation benefit. Short-term capital gains in this case are taxed at your slab rate.

Scenario 2: If you invested after April 1, 2023 - Your debt mutual funds are taxed at your income slab rate irrespective of it’s holding period.

Trusted by 10 million+ happy investors

Open your account in a minute. Invest in Indian Stocks, US Stocks, Mutual Funds, ETFs, Fixed Deposit and NPS.

INDmoney is 100% Safe and Secure!

Your security and privacy are our top priority!

27001:2022

ISO Certified

Audited by

cert-in empanelled auditors

AES 256-BIT

SSL Secured

Your personal information is protected.

With AES 256-bit encryption and TLS 1.3 secure data in transit.