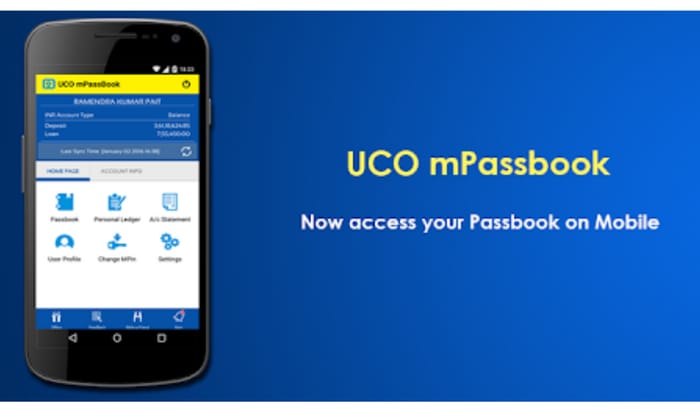

UCO Bank mPassbook

The UCO mPassbook is an app designed for digital passbook access, enabling users to conveniently view their passbooks on their mobile devices. Users need to register only once to access the application online. Through the UCO Bank mPassbook, users can easily view their account statements and monitor their debit/credit history. This convenient online application saves UCO Bank customers from repeated visits to the branch just to view their transaction details.

This content provides details about the features of UCO m Passbook, its components, and the procedure for downloading and logging into the mPassbook application.

UCO mPassbook - Features

The primary features of the UCO Bank m Passbook application include:

Digital Passbook:

UCO mPassbook serves as a digital rendition of the physical passbook, providing users with access to account balances, transaction histories, and bank account details via their smartphones.

24x7 Availability:

The m Passbook app offers round-the-clock accessibility, allowing users to access their bank account details at any time and from anywhere.

Multilingual Support:

UCO Bank mPassbook supports 12 languages, catering to a diverse user base, including English, Hindi, Bengali, Marathi, and Gujarati, among others.

User-Friendly Interface:

The application boasts an intuitive and straightforward interface, ensuring ease of use for its users.

Send E-Statements:

Users can utilise the m Passbook app to conveniently send detailed statements to their registered email addresses.

Locate UCO Bank Branches/ATMs:

The app facilitates the locating of nearby UCO Bank branches and ATMs, providing added convenience to users.

UCO Bank mPassbook- Components

The UCO digital passbook or mPassbook application encompasses identical details found in the regular UCO Bank passbook. The included details within the UCO mPassbook application consist of the following:

- Account holder’s name, address, registered phone number

- UCO Bank account number and customer ID

- Branch address

- IFSC Code

- Transaction specifics, encompassing debit/credit amount, transaction date, time, and transaction ID

UCO mPassbook- Method to Register

The registration process for UCO Bank m Passbook services involves these steps:

- Download and install the UCO Bank m Passbook application from the iOS Store or Play Store.

- Open the downloaded application and proceed by clicking on ‘Continue’.

- Review the provided terms and conditions, then click ‘Agree’ to proceed.

- Enter your UCO bank account number and the associated phone number. Click ‘Proceed’ to continue.

- Authorise the application to manage phone calls by selecting ‘Allow’.

- Confirm your displayed name and account number. Click ‘Correct’ after verifying the accuracy of both details.

- Enter the OTP sent to your registered phone number and click ‘Submit’.

- For UCO mPassbook login, create a unique four-digit MPIN. Enter the MPIN and click ‘Confirm’ to complete the UCO Bank mPassbook registration process.

UCO mPassbook- Login Process

To access the mPassbook services of UCO Bank through the UCO mBanking+ mobile application, follow these steps:

UCO Mobile Banking

- Download the UCO mBanking+ application from the Play Store or App Store.

- Upon installation, sign in to the app using your MPIN.

- Locate and select the 'mPassbook' option within the app.

- Choose the desired account number and proceed by clicking the 'Continue' button.

- You'll gain access to your digital Passbook, displaying previous transaction data alongside corresponding dates and times on the screen.

UCO mPassbook App Download

To log in to the UCO Bank mPassbook, follow these steps:

- Open the mPassbook application and log in using your MPIN.

- Enter your account number.

- Access the subsequent page to view the mPassbook, which will present your account details and display the last ten transactions.

- Additionally, you can select and download account statements for the latest 90 days onto your smartphone for future reference.

What is the major use of the UCO M passbook?

UCO M passbook allows its customers to acknowledge their passbooks digitally on mobile phones. The user only needs to register to use this application online. Users can check their account statements and track their credit or debit card history with the help of this digital UCO bank M passbook.

How can I check my last three transactions in the UCO m passbook?

You can check your last 3 to 5 months' transactions on the M passbook app of UCO bank and also generate a statement that will be dropped on your registered email ID.

What is the MPIN for the UCO bank passbook?

Users must set the MPIN at the time of UCO M passbook registration. It is a four-digit security password that allows users to log in and access their M passbook application.

Do I need to provide my phone number for the UCO Bank M passbook?

Yes, you must provide the registered mobile phone number that you have linked to your bank account to use the UCO Bank mPassbook.