Mutual Funds

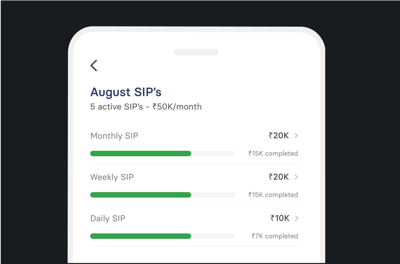

Invest in Zero Commission Direct Plan Mutual Funds online. Easily switch to Direct Plans at no cost and manage SIPs with full control - edit, pause, or cancel anytime. All your SIPs are tracked on a single dashboard for convenience.

Explore 5000+ Mutual Funds

Zero Commission Direct Plans

₹0 Maintenance Cost

No Hidden Charges

What is a Mutual Fund?

A pool of investments is what mutual funds provide. As an investor, you can buy some shares of that pool of investment funds. And each unit of share you hold in your portfolio will change every day with the market.

Ways to Invest in Mutual Funds: SIP vs Lumpsum

SIP is about regularly investing a fixed amount in a mutual fund, while lump sum involves making a single large investment instead of smaller, regular investments over time.

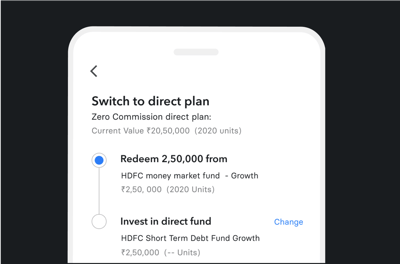

Regular Plan vs Direct Plan Mutual Funds

Regular plan mutual funds come with commission fees included in the expense ratio, while direct plan mutual funds have zero commission charges, resulting in a lower expense ratio and potentially higher returns.

Mutual Funds by Category

Mutual funds can be classified into three main categories: Equity, Debt, and Hybrid Mutual Funds.

1. Equity Mutual Funds

Large Cap Mutual Funds

Invest smartly and aim high with Large Cap Mutual Funds, your path to consistent returns and financial success. These funds invest at least 80% of their assets in top 100 companies of by market cap.

2. Debt Mutual Funds

Liquid Mutual Funds

These funds invest in low-risk, easily accessible money market instruments, providing a safe option for parking your short-term cash. They offer modest returns, capital preservation, hassle-free access with no lock-in, entry/exit loads, minimal risk, and the convenience of one-day withdrawals.

3. Hybrid Mutual Funds

Conservative Hybrid Mutual Funds

Conservative hybrid funds provide a low-risk investment option by combining a mix of debt instruments like corporate and government bonds and equity instruments like stocks, making them a suitable choice for risk-averse investors seeking stable returns with a balanced portfolio.

Mutual Funds Collections

Trending Funds

Invest in funds that have been popular with the INDmoney investors in the past 6 months.

Build Wealth

Top Performing Mutual Funds are investment vehicles known for consistently outperforming their peers by delivering superior returns.

Tax Savers / ELSS

Equity-Linked Savings Schemes (ELSS) are tax-saving mutual funds that invest primarily in equities and equity-related instruments. These funds offer the dual benefits of potential capital appreciation and tax deductions under Section 80C of the Income Tax Act in India.

Gold Mutual Funds

Gold mutual funds offer investors a convenient and cost-effective way to potentially benefit from the price movements of gold without physically owning the precious metal, providing a hedge against inflation and market volatility for potential long-term growth.

High Return Funds

High Return Funds are investment vehicles strategically designed to achieve superior returns by focusing on high-growth assets like equities and high-yield securities.

Best SIP Funds

Best SIP Funds is a list of hand-picked mutual fund schemes that have given better SIP returns compared to other Funds in the same category.

Low Risk Funds

Provides stability and preserve capital while offering modest returns. These funds typically invest in securities that have lower volatility and are less sensitive to market fluctuations.

Moderate Risk Funds

These mutual funds are investment vehicles designed to offer a balance between risk and return, catering to investors who seek a middle ground between aggressive growth and capital preservation.

High Risk Funds

These funds are investment vehicles designed for investors who are willing to accept a higher level of risk in exchange for the potential for substantial returns.

Index Funds Collections

Nifty 50 Index Funds

Nifty 50 index funds aim to replicate the performance of the Nifty 50 index, offering exposure to India's top 50 companies and providing a diversified investment in large-cap stocks.

Nifty Next 50 Index Funds

Nifty Next 50 index funds track the Nifty Next 50 index, targeting the next 50 largest companies after the Nifty 50, providing investors with growth potential in emerging large-cap stocks.

Mid Cap Index Funds

Nifty Midcap index funds invest in the Nifty Midcap 100 index, focusing on medium-sized companies that offer a balance of growth and stability, with higher risk than large-cap funds.

Small Cap Index Funds

Nifty Small Cap index funds track the Nifty Small Cap index, investing in smaller companies with high growth potential but greater volatility, suitable for risk-tolerant investors.

Best Index Funds

Best index funds offer broad market exposure by tracking well-known indices like the Nifty 50 or Nifty Next 50 making them ideal for long-term, low-cost investment.

Global Index Funds

Global index funds provide exposure to international markets by tracking indices like the NASDAQ or S&P 500, allowing investors to diversify beyond Indian markets and benefit from global market performance.

Types of Mutual Funds

Equity Funds

Large Cap

Flexi Cap

Mid Cap

Large & Mid Cap

Small Cap

Nifty 50 Index Funds

Nifty Next 50 Index Funds

Mid Cap Index Funds

Small Cap Index Funds

Multi Cap

Focused Funds

Dividend Yield

Value Funds

Technology Funds

Infrastructure Funds

Banking Funds

Consumption Funds

Energy Funds

ESG Funds

FMCG Funds

Sectoral Funds

Thematic Funds

Global Index Funds

Other Index Funds

Debt Funds

Liquid Funds

Corporate Bonds

Short Duration

Low Duration

Money Market

Bank & PSU

Gilt Funds

Overnight Funds

10 Yr Govt Bond Funds

Credit Risk

Floater Funds

Long Duration Funds

Medium Duration Funds

Dynamic Bonds

Med to Long Duration Funds

Ultra Short Duration Funds

Hybrid Funds

Balanced

Aggressive

Arbitrage

Multi Asset

Conservative

Equity Savings

Funds of Funds

Retirement Funds

Children Funds

Mutual Fund Calculators

Mutual Fund Calculators help you estimate your returns from mutual fund investment, especially for SIPs. They can be used to calculate expected earnings based on investment amount, frequency, and time period of investment.

SIP Calculator

Estimates the final amount you could get from making regular SIP investments

Regular vs. Direct Plan Calculator

Shows you how much you can save on fees by choosing a direct plan over a regular one

Mutual Fund Returns Calculator

Calculates what your investment could grow to over a certain period

Step Up SIP Calculator

A Step-Up SIP Calculator helps you estimate the future value of your investments by factoring in periodic increments to your SIP contributions. This tool allows you to visualize potential growth and make informed decisions for achieving your financial goals.

Lumpsum Calculator

A Lumpsum Calculator allows you to determine the future value of a one-time investment by accounting for the rate of return and investment duration. This tool helps you plan and visualize your wealth accumulation over a specified period.

Advantages of Investing in Mutual Funds via INDmoney

INDmoney provides you an easy, fast, safe and FREE way of investing in Direct Plan Mutual Funds at ZERO commission with powerful features!

SIP Center to Control all your SIPs

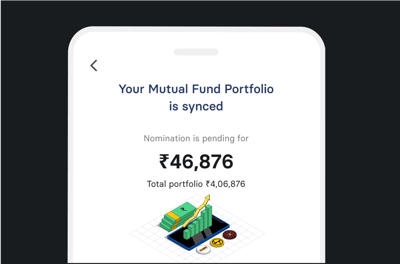

Track & import your external mutual funds

Switch from Regular plan to Direct plans

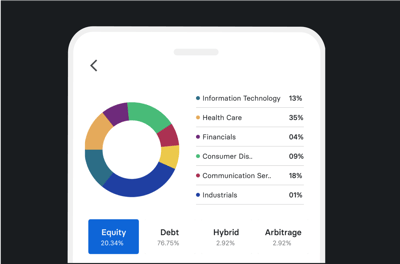

Get Free Analytics of your Mutual Funds

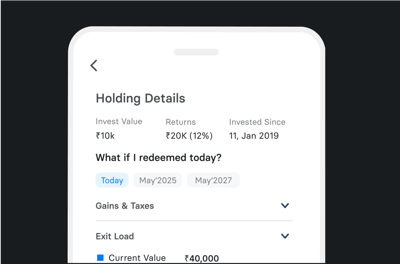

Find hidden charges, exit loads & tax implications

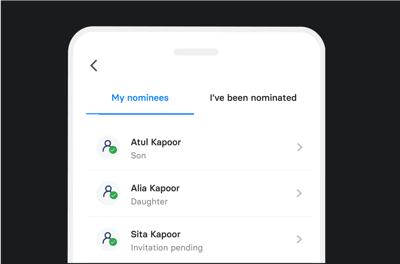

Set up nominees for your mutual funds

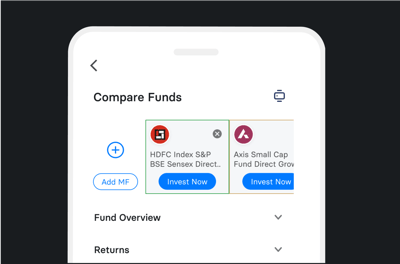

Compare mutual funds across returns, cost, AUM, etc

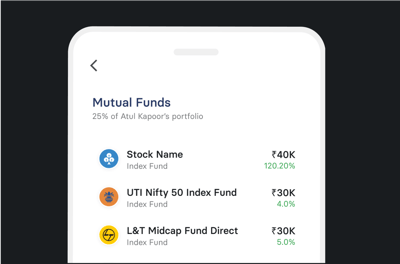

Manage funds across your family members

Get news insights of your mutual funds

How to start investing in Mutual Funds with INDmoney?

Now that you have understood what mutual funds are, you need to know how easily you can start your investment with INDmoney. Just follow these simple steps given below, to start your mutual fund investment journey with us.

Step 1

Download the INDmoney app and create your free investment account by completing your KYC ( Know Your Customer).

Step 2

Once your Free investment account is ready, you can either search for a mutual funds or go to the mutual fund section from the dashboard or INDstocks section.

Step 3

Choose a Mutual Fund by looking at aspects like past returns, volatility, downside capture ratio, AUM, Expense ratios and underlying stocks and sectors.

Step 4

Step 5

Choose the amount that you want to invest as SIP or LumpSum.

Step 6

Set up payments. If you choose to set up SIP in mutual funds, you can do a free automatic pay set up via bank mandate or UPI. If you choose to invest in lumpsum (one-time) then you can pay via UPI, netbanking, NEFT or RTGS.

Frequently Asked Questions

The full form of NAV is Net Asset Value, which is the mutual fund's per-share value. It is the amount you pay or get when you buy or sell a mutual fund share.

Yes, by investing in specific mutual funds like ELSS (Equity Linked Savings Scheme), you can save on taxes. These investments qualify for tax deductions under Section 80C of the Income Tax Act, helping you reduce your taxable income.

An NFO, or New Fund Offer, is the first time a new mutual fund scheme is offered to the public.

Yes, we have an option of Flexi SIP where we can pause and restart the SIP.

We also give an option to edit our SIP anytime. Follow the steps below to change the SIP amount.

Step 1: Go to the SIP section, under mutual fund dashboard.

Step 2: Open SIP Summary Page and click on manage SIP

Step 3: A bottom sheet will appear, click on edit SIP.

Step 4: An invest page will open, here you can edit your amount.

Note : Maximum Mandate amount should cater the new updated SIP amount.

For Example, if you have started a SIP via UPI and you have created a mandate for Rs 10000. In this case if you edit your SIP amount to 15000, you will receive invalid input.

You can edit the amount between SIP minimum investment amount ( created by AMC ) to maximum mandate amount ( created by user )

Journey to download the ELSS report on the INDmoney mobile app:

Step 1 → Go to the “My Profile” section by clicking on your profile picture on the left side of the screen.

Step 2 → Scroll down and select Mutual Fund account ( BSE ) from the “account details” section

Step 3 → Click on the “ELSS Report” button from the “Reports” section.

Step 4 → “Select Financial Year” and download the ELSS report.

Step 1 → Select the “Mutual Funds” tab

Step 2 → Click on the down arrow near the “overall portfolio”. A bottom sheet will appear.

Step 3 → Click on the “refresh portfolio” button on the bottom sheet.

Step 4 → Enter OTP

Step 5 → Click “my funds” to see your external portfolio.

Below are the steps to cancel ongoing SIP from INDMoney.

Step 1 → Select SIP chiclet from the “Orders” Tab.

Step 2 → Select the SIP you want to cancel

Step 3 → Click on the “Manage SIP” button.

Step 4 → Select “Cancel SIP” from the Manage SIP bottom sheet

Step 5 → Click on Cancel SIP from the bottom sheet

Adding a nominee to your mutual funds makes it simpler and faster to transfer your investment to your chosen nominee if something happens to you. It's a way to ensure your investments are easily passed on to the person you choose, without complications.

You cannot remove an external portfolio once you have fetched it on the INDmoney App platform.

If your SIP falls under a non-business day then SIP will get processed on the next business day.

To check this → You can see your SIP amount separately under the SIP chicklet in the “Orders” Tab.

Note: If you have redeemed that particular fund once, you will not be able to you cannot track it separately.

Here are the steps involved to redeem you mutual funds

Step 1 --> On the INDmoney App, go to the main dashboard and click on mutual funds.

Step 2 --> Once you get to the Mutual Fund Main Home Page, select the My Funds tab.

Step 3 --> On the My Funds tab, select the mutual funds you want to redeem.

Step 4 --> After selecting the fund, a bottom sheet will open. Click on the View Details Button.

Step 5 --> Click on Redeem Button. A bottom sheet open, You can select between 1. Redeem One-Time or SWP (Systematic Withdrawal Plan)

Step 6 --> Enter the amount you want to redeem.

Step 7 --> Enter the OTP

Step 8 --> A screen will appear where you will find your sell order details. You will get the NAV date and the date when the amount will be credited in your bank account.

Super Finance App

Build Your Portfolio Today

Start Building your wealth

Trusted by 10 million+ happy investors

Open your account in a minute. Invest in Indian Stocks, US Stocks, Mutual Funds, ETFs, Fixed Deposit and NPS.

INDmoney is 100% Safe and Secure!

Your security and privacy are our top priority!

27001:2022

ISO Certified

Audited by

cert-in empanelled auditors

AES 256-BIT

SSL Secured

Your personal information is protected.

With AES 256-bit encryption and TLS 1.3 secure data in transit.